CRM For Financial Services Industry

CRM designed for financial services

The best CRM for lending solution, loan origination system, debt collection and banking

Ragini M20/12/20233 min reading time

Why do Financial services need CRM?

Financial services companies need CRM to manage client relationships, streamline communication, and track financial transactions efficiently.

- Super-fast Implementation: Rapid implementation allows businesses to start using Appzo in a matter of days

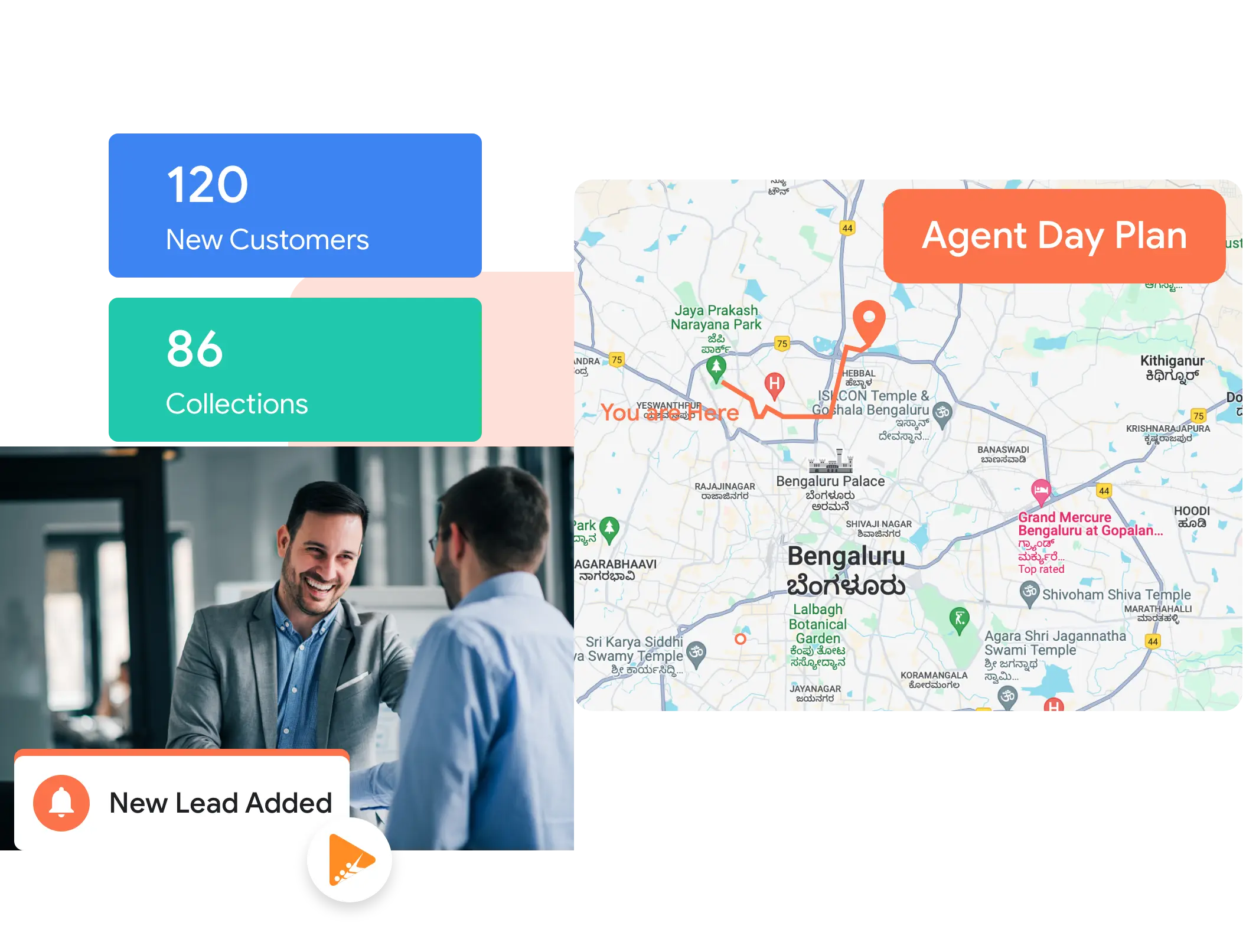

- Mobile CRM built for Sales: Agents can efficiently plan their day, identify nearby prospects, and track activities in real-time

- Configurable Workflows: Tailor workflows to ensure that customer acquisition, engagement, and sales operations align

- Completely Secure: Strict security measures instill confidence in prospects and customers, building trust in the system

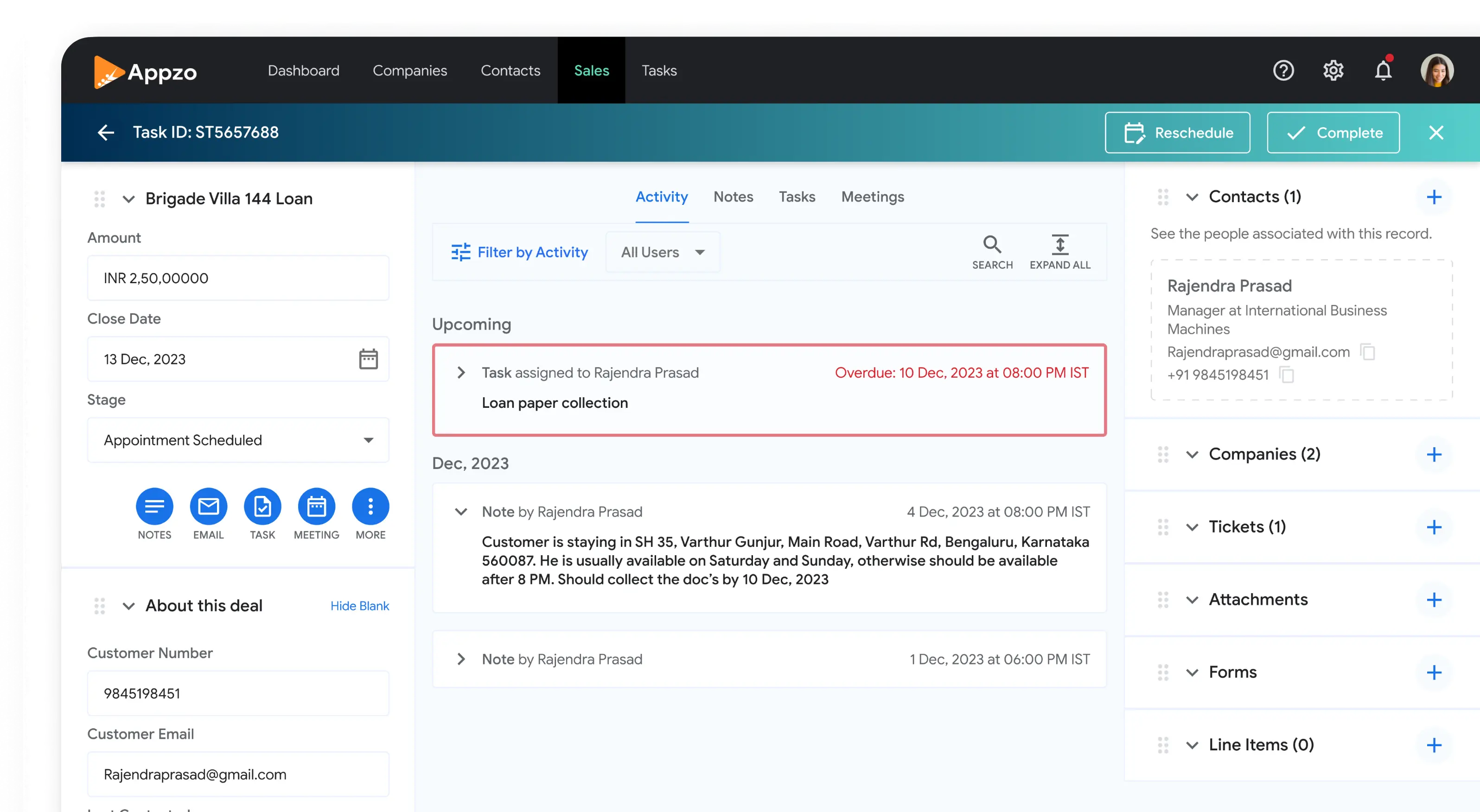

- Manage Loan Application: The branded digital portal simplifies and accelerates the loan application process, creating a seamless and efficient experience

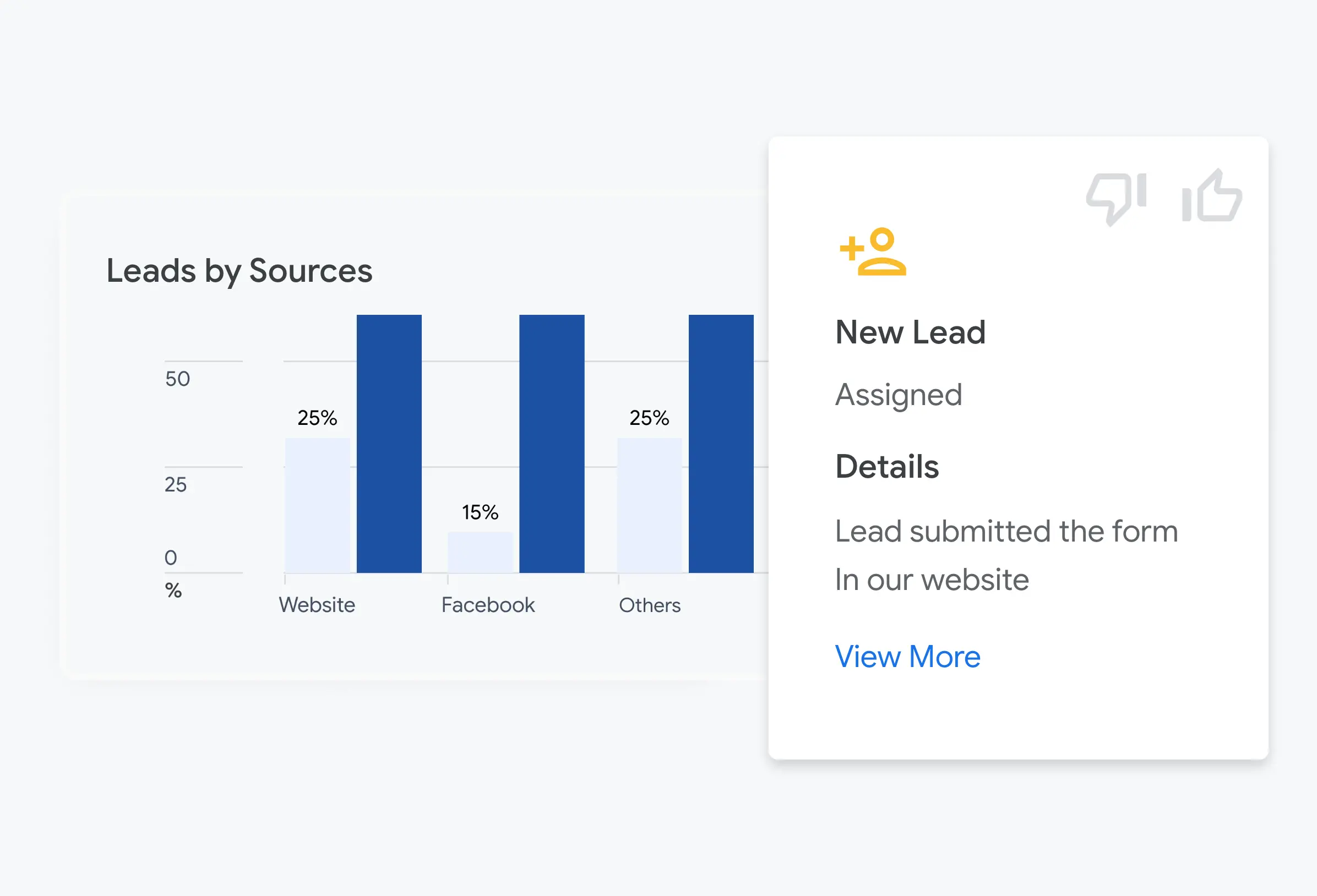

- Performance Reports: Reports provide valuable insights, empowering teams and agents to make data-driven decisions

Try out Appzo for free!

Want to discover Appzo for yourself? Create your free account now and explore Appzo's messaging platform.

"We want to be reachable on all channels for our customers."" Raj Mishra, Head of Marketing

Raj Mishra, Head of Marketing

Revolutionizing Banking Sales

Banking CRM platform

- Core Customer Record Integration: Complement your core customer record system for a unified platform.

- End-to-End Customer Lifecycle Management: Acquire, engage, onboard customers, and cross-sell seamlessly.

- Cost Efficiency: Reduce customer acquisition and ownership costs while securely connecting all teams and core systems.

Appzo for banking

- Rapid Implementation: Super-fast implementation in days compared to months for other enterprise banking software.

- Cost Reduction: Reduce operational costs associated with customer acquisition and management.

- Secure Connectivity: Connect all teams and core systems securely for streamlined operations.

Multi channel engagement

- Diverse Engagement Channels: Drive prospects to conversion through email, text, WhatsApp, call center, and more.

- Enhanced Prospecting: Identify prospects near agents for targeted engagement.

- Holistic Sales Tracking: Track all field activities of agents for comprehensive sales management.

Mobile CRM for sales

- Efficient Day Planning: Plan agents' daily activities comprehensively for optimized productivity.

- Prospect Identification: Allow agents to identify and engage with prospects in their vicinity.

- Real-time Field Tracking: Track all field activities, ensuring accountability and performance measurement.

CRM for Different Banking Sectors

Retail banking

- Seamless Customer Acquisition: Streamline the acquisition process from prospect to customer.

- Effective Prospect Communication: Engage with prospects through various channels for increased conversions.

- KYC Verification: Efficiently manage KYC verification processes within the CRM.

- Upsell/Cross-sell Engine: Implement effective upsell and cross-sell strategies for enhanced revenue.

- Connected Systems & Teams: Ensure integration and collaboration across banking systems and teams.

Debt recovery

- Borrower Management: Efficiently manage borrower information and interactions.

- Categorization and Prediction: Categorize borrowers and predict recovery outcomes.

- Guided Team Actions: Provide guided actions for the recovery team based on analytics.

- Advanced Analytics: Utilize advanced analytics for proactive debt recovery strategies.

Corporate banking

- Holistic Account Management: Manage corporate accounts comprehensively.

- Data Enrichment: Enrich customer data for enhanced insights and relationship management.

- Customer Portfolio Analysis: Analyze and manage the corporate customer portfolio effectively.

- Field Sales Planning: Plan field sales activities for improved corporate banking operations.

"We want to be reachable on all channels for our customers."" Raj Mishra, Head of Marketing

Raj Mishra, Head of Marketing